Where Does Irs Fire System Find File to Upload

Table of Contents

- Before you lot begin

- Logging in

- Uploading a file

- Checking your file status

- Mark your file every bit Submitted in Payroll Organisation

- Earlier you brainstorm

- Logging in

- Uploading a file

- Checking your file status

- Mark your file equally Submitted in Payroll Arrangement

All use of the FIRE Arrangement website and filing of Information Forms is entirely the user'southward responsibility. This is not a replacement for IRS instructions or tutorials. Additionally, FIRE Organization spider web pages are subject to change. See IRS Pub 3609 for detailed instructions.

Unlike many websites, the Fire Organisation website does non log you out automatically. Always keep security in mind when leaving your work or finishing your session there.

Burn down System Cyberspace Security Technical Standards

• HTTPS 1.1 Specification

• TLS 1.2 is implemented using SHA and RSA 1024 bits during the asymmetric handshake

The Filing Data Returns Electronically (FIRE) Production and Test System server no longer supports Secure Socket Layer (SSL) iii.0 every bit one of the Burn down System's Internet Security Technical Standards. Transmitters using IE six.0 or lower equally their browser may have problems logging in and connecting to the Burn down System. Follow the steps below to connect and upload a file:

• Become to Tools > Net Options > Avant-garde

• Scroll down and find Security

• Uncheck both SSL 2.0 and SSL 3.0

• Check TLS 1.ii and select "Utilize"

Before you lot begin

You must starting time create your file for IRS upload in Payroll System's: "Create 1098/1099/Due west-2G efile/MagMedia Files" module. Refer to 1099 E-Filing Overview.

The Create 1098/1099/W-2G efile/MagMedia Files module will oft exist referred to in these instructions every bit the 1099 East-Filing module, for simplicity.

Throughout these instructions, 1099 e-filing will be referenced. 1098 and W-2G eastward-filers may likewise follow the same instructions.

If your existing TCC hasn't been used in 2 years so it may no longer be valid and you volition be required to get a new TCC. To acquire a TCC, run across Applying for a Transmittal Control Lawmaking (TCC).

See IRS Fire Organization login changes for login requirements.

Logging in

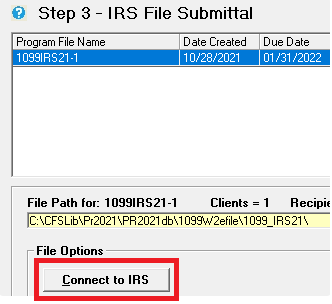

- Connect to the IRS FIRE Organisation website in 1 of 2 ways: 1) click here, or 2) click Connect in Footstep three of the 1099 Due east-Filing Module in Payroll System (shown below).

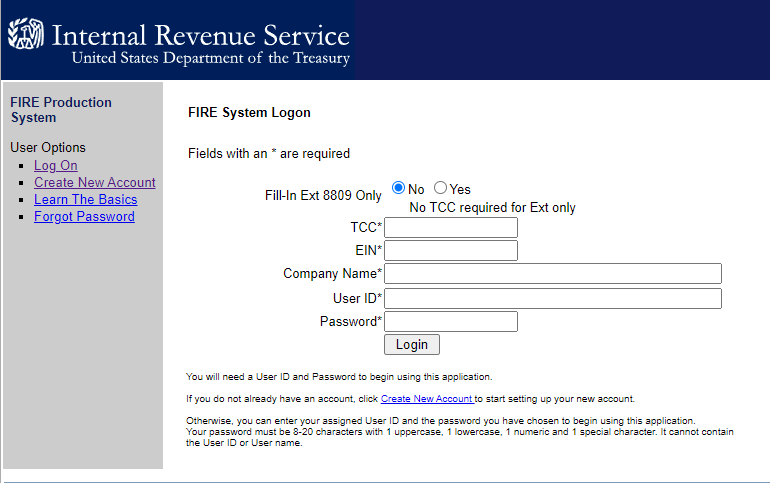

- The login screen is displayed in your default browser. Log in using your FIRE Organisation business relationship User ID, Password, and Company Proper noun exactly as information technology appears on the Fire Organisation.

The Company Proper name to be input exactly every bit it appears on the FIRE Arrangement. The Company Name is typically the Legal Business Name you used when applying for your TCC (or as yous've updated through Form 4419). It generally should not include punctuation or special symbols (with the exception of the ampersand ("&") or hyphen ("-").

it takes time for the IRS to update a recently filed Form 4419 in their organization. If you've recently changed your legal business proper name on Course 4419, your new Company Proper noun may non yet exist attainable for Burn's internal verification.

You may call the FIRE Organization TSO line for login and other problems at (866) 455-7438.

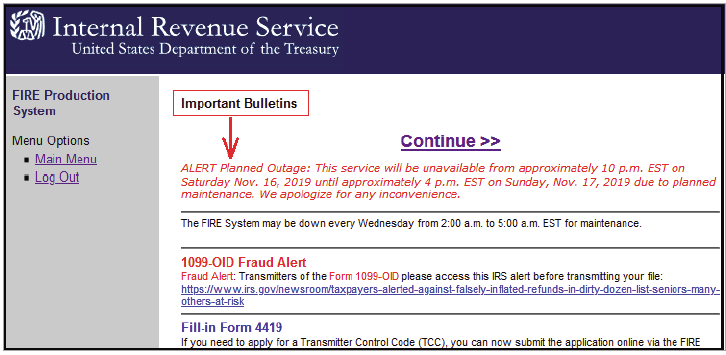

- After logging in, you will see a page of Of import Bulletins. There may be important announcements/info on this webpage, such as planned outages of the FIRE system. Afterward reading the bulletins, click Proceed.

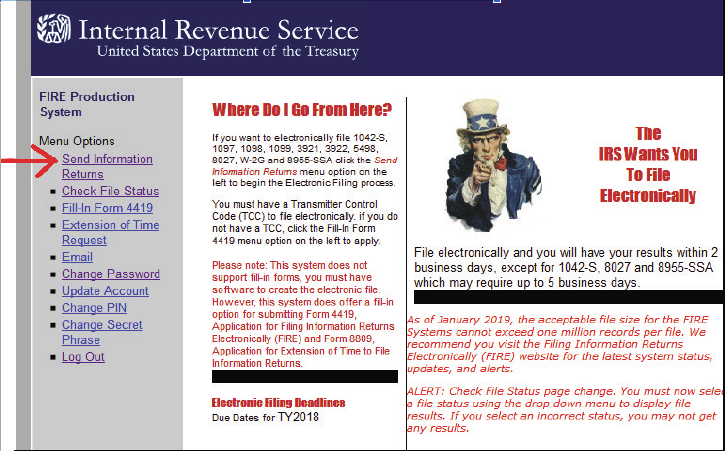

- Click Send Data Returns from the carte du jour.

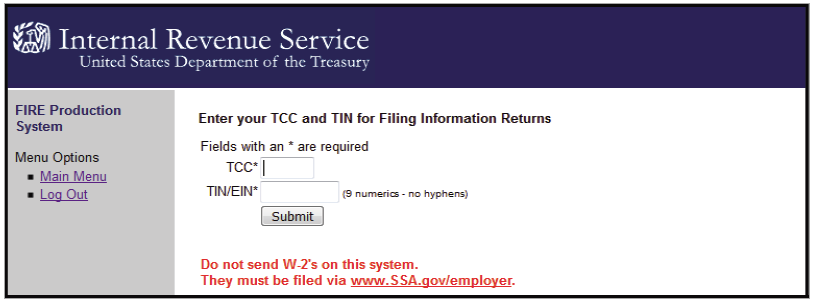

- On the next screen, the FIRE System volition ask you to enter your TCC (Transmitter'due south Control Code). This number is furnished to you lot (the Transmitter) by the IRS after you file IR Application.

Exercise not utilise any hyphen with the TIN/EIN number.

Pasting is non recommended. If y'all paste TIN/EIN including a hyphen, it won't enter the terminal digit. Copying/pasting will supervene upon your created File Name and Path on your Windows clipboard.

- Click Submit.

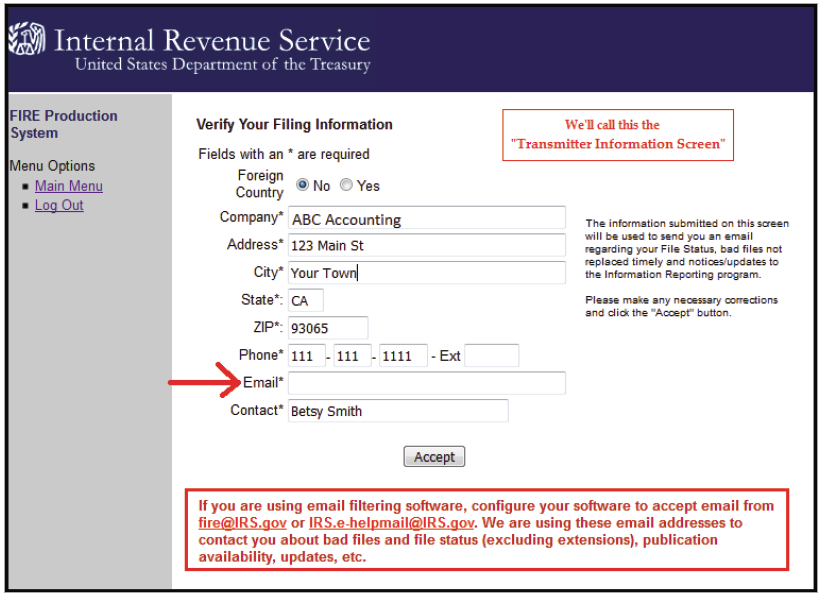

- If your Transmitter information is correct, click Take.

You may need to add together or correct your e-mail address, which the IRS will use to send submission status updates and other information (see IRS text in red below).

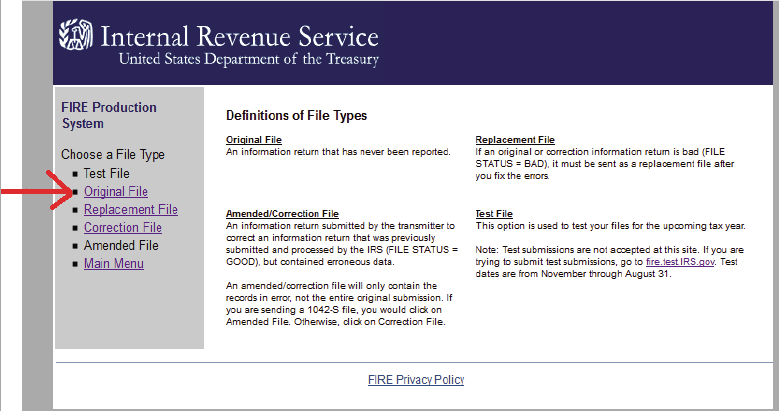

- Click Original File from the carte du jour to get-go an information return that has not notwithstanding been reported.

- The FIRE System may then have two repetitive screens (re-enter numbers and electronic mail).

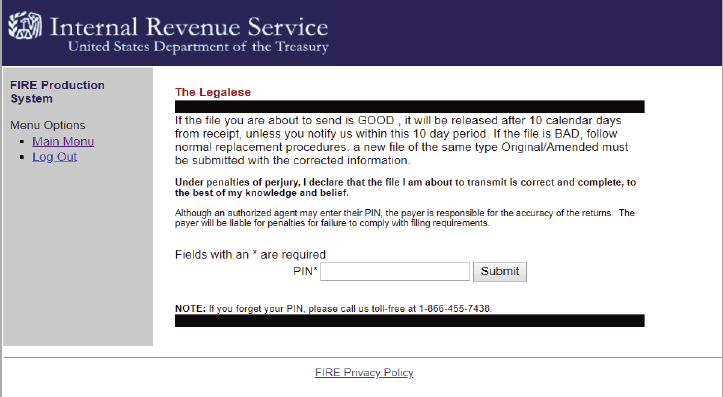

- Enter the correct Pin number then click Submit. Your PIN is commonly 10 digits and was cocky-chosen when you originally created an account on the FIRE Organisation.

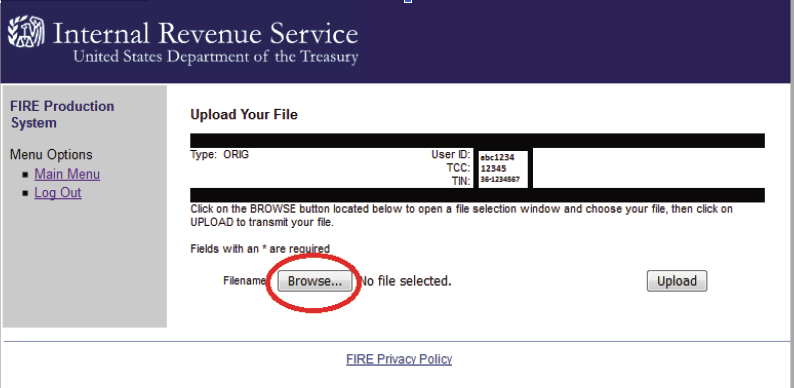

Uploading a file

Some Browsers prove a dissimilar format. Instead of Browse it may say Choose File.

- Click Browse (some browsers may substitute Choose File instead of Browse).

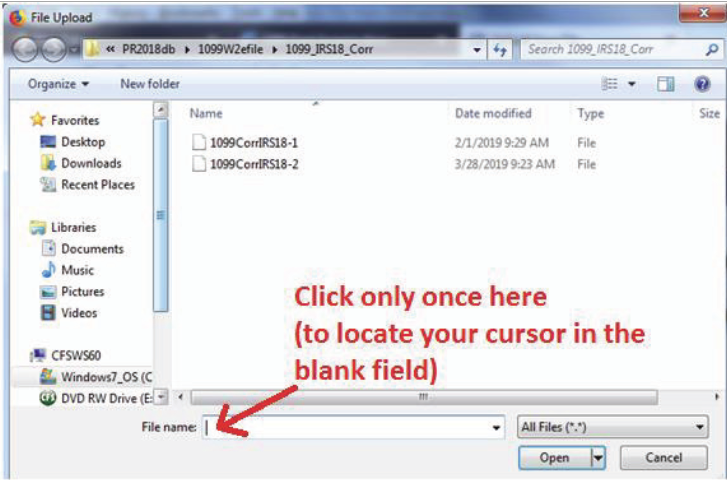

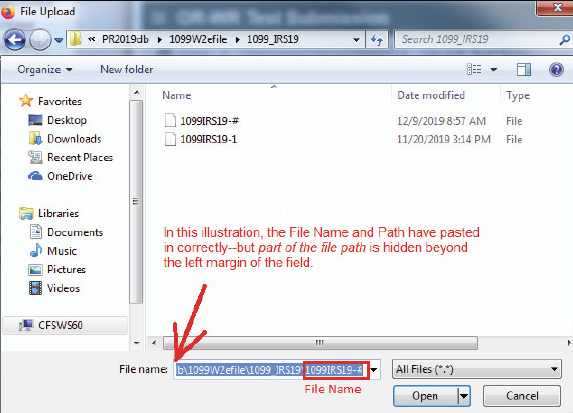

- A File Upload dialog is displayed. Click the blank field next to File name in one case (and only once).

- Paste the file name either by typing CTRL + V, or right-clicking on the blank field and selecting Paste.

This assumes you lot clicked on the correct record in the e-filing module in Payroll Organisation, as represented below. Doing and so automatically copies the correct path and file name to your clipboard. Or, you can manually navigate to your file.

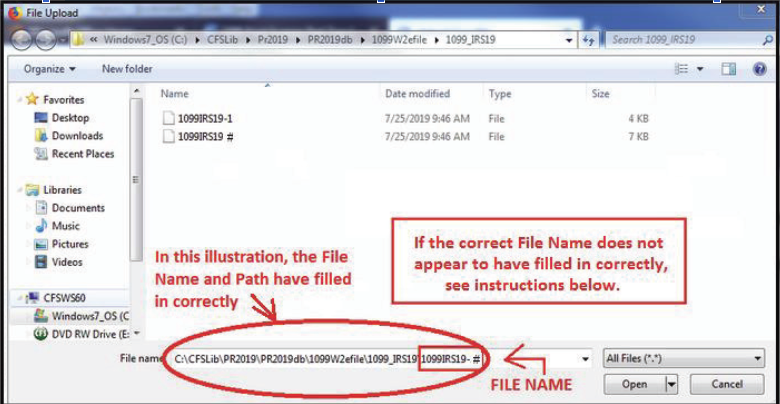

- If but part of your file proper noun or path appears to be missing, this is very common. It is ofttimes hidden beyond the left (or correct) margin of the field. Scrolling left (or right) inside the File Name field should reveal the rest of your pasted file path or proper noun. Sometimes enlarging the size of the dialog box can also bring the full path into view.

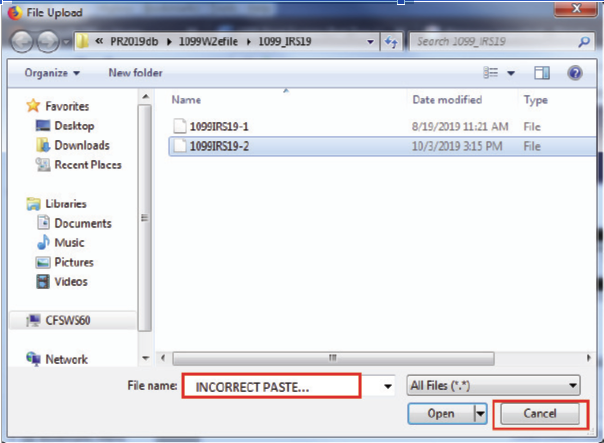

- If the file name (and path) does NOT appear to have filled in (or if nothing has filled in), it may not have been on your clipboard. Click the Cancel, and click here to easily re-copy before proceeding.

- If but part of your file proper noun or path appears to be missing, this is very common. It is ofttimes hidden beyond the left (or correct) margin of the field. Scrolling left (or right) inside the File Name field should reveal the rest of your pasted file path or proper noun. Sometimes enlarging the size of the dialog box can also bring the full path into view.

- If the File name is correct, click Open (or Save, depending on your browser).

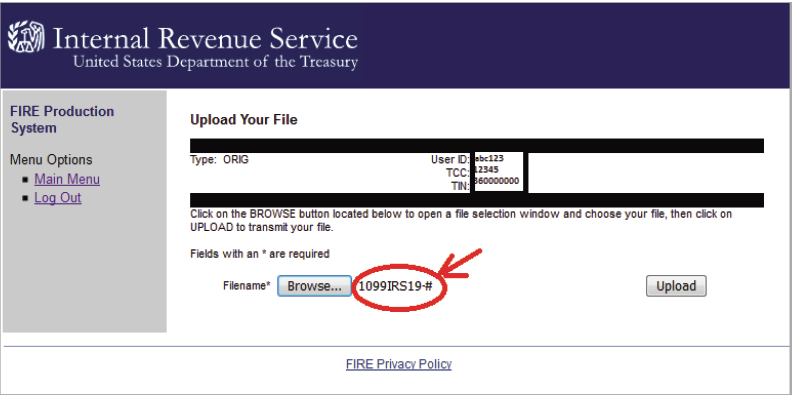

The file proper noun now appears to the right of Scan (or Choose File). This file name should be the same equally the file y'all saved in Step 2 and Step three of the 1099 E-Filing module (which when y'all selected, was highlighted in blue).

If the file name is Non correct, exercise not proceed and instead click here.

- Click Upload. After a few seconds, the File Upload Statistics page appears.

If it doesn't appear subsequently a few seconds, call CFS tech support at (800) 343-1157. There has been a problem with the IRS receiving your uploaded file.

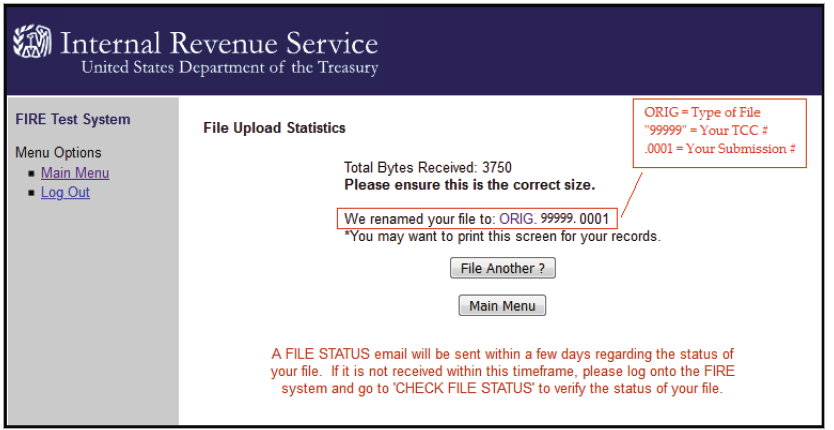

Compare the Full Bytes Received to that of your intended file to verify that you take uploaded the correct file.

Note how the IRS has "renamed" your file, which name includes:

• "ORIG" stands for "Original" submission.

• Your TCC in the center position.

• Your submission number is at the end.More near this screen

Note how the IRS has "renamed" your file, which name includes:

• "ORIG" stands for "Original" submission.

• Your TCC in the center position.

• Your submission number is at the cease.If this is your very offset upload as a transmitter, the submission number will stop in "0001". Future submissions will exist numbered sequentially, "0002", "0003", etc. Notwithstanding, in addition to this FIRE assigned proper name, the Burn Organisation volition likewise maintain your original uploaded file name, equally nosotros volition soon illustrate.

The ruby-red text at the bottom is a reminder that the IRS should e-postal service you the condition of your file within a few days. We will also illustrate how to check the status of your file on the FIRE website, next.

- It is strongly recommend that you print the File Upload Statistics page. Type Ctrl + P.

- Be sure to go back to the Burn System website to check your file condition if they do not positively ostend the status of your file with an email in a couple of days.

To practice checking your file condition, click Main Carte and see Checking File Status in this article.

- Go along processing any remaining 1099 files or process your state files.

Checking your file status

See Checking your file status.

Mark your file every bit Submitted in Payroll System

- Open Payroll Arrangement.

- Open up the 1099 E-Filing Module.

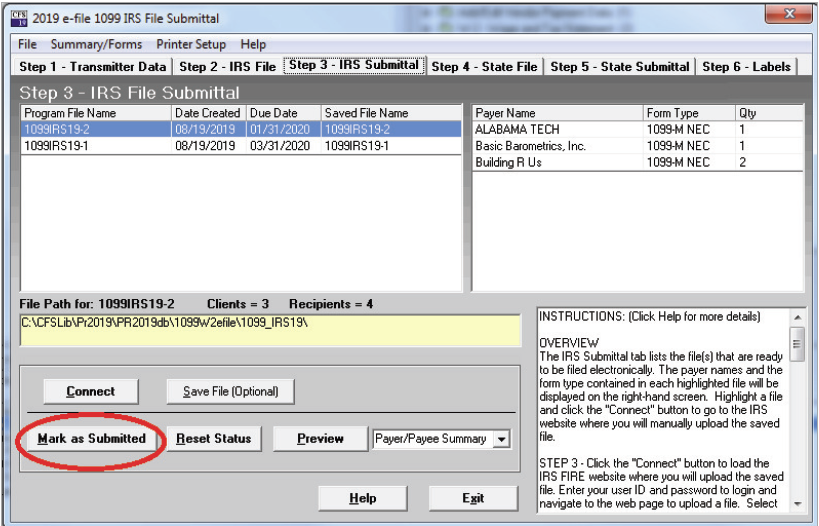

- Click Step 3 - IRS Submittal.

- Click the correct file to select information technology and click Mark equally Submitted.

We strongly recommend marking the file as Submitted immediately. Some users choose non to exercise then until they've verified the file was accepted by the IRS FIRE Arrangement without errors, but this may result in inadvertently uploading a duplicate submission to the Fire Organisation.

Fifty-fifty if the file is later reported by the IRS/Burn down System as Bad, it'due south useful to have information technology marked as Submitted. The record is important, and typically, a Bad file is REPLACED rather than re-submitted).

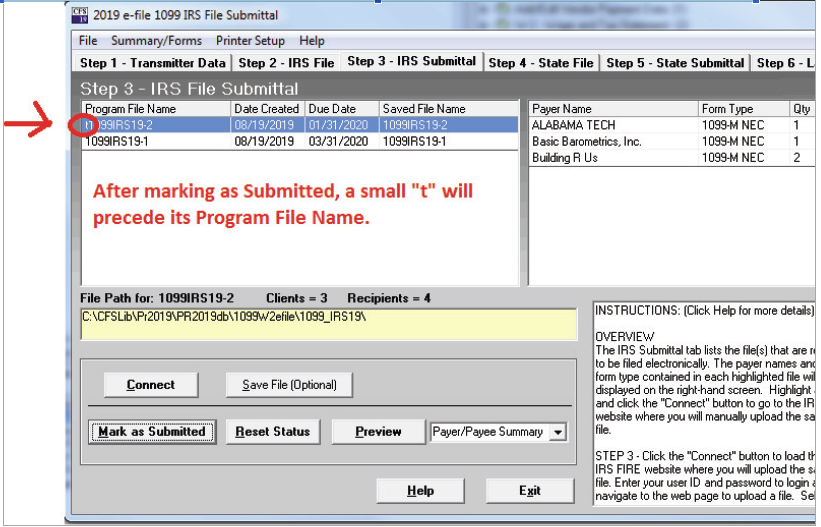

One time you've marked as submitted, a modest "t" volition precede its Program File Name.

If you later create more files in the 1099 Eastward-Filing module, the by files that accept been marked as Submitted volition exist grayed out.

How did we do?

1099 E-Filing: Filing Corrections

1099 Due east-Filing: submitting prior year files

Source: https://help.taxtools.com/article/j7kko3wlvc-navigating-the-irs-fire-system-website

0 Response to "Where Does Irs Fire System Find File to Upload"

Post a Comment